European Stocks Show Signs of Fatigue as Ibex 35 Falters

Spain's benchmark index struggles to hold opening gains, while silver prices plunge on tariff news.

European equities, led by Spain’s Ibex 35, have shown signs of bullish fatigue in recent sessions. The Spanish benchmark has closed below its opening level for two consecutive days, a pattern clearly visible on a candlestick chart when the real body is black, explained Joan Cabrero, a technical analyst and strategist.

“It’s not serious, but it does indicate that the buying momentum seen at the open is not sustained by the close,” Cabrero noted. “The buying pressure is still there, but it doesn’t finish the job.”

Despite this dynamic, the strong uptrend that has seen the Spanish index chain together several weekly closes above the prior week’s low looks set to continue. “There will be no reason to talk about buyer exhaustion in the short term as long as the Ibex does not break this sequence, which marks the real pulse of the market,” Cabrero said, highlighting that a close below 17,446 points would be needed to signal a shift.

The low of 17,400 points seen during Monday’s brief downturn now stands as a key support level. A breach of that level “would break that dynamic and begin to sow reasonable doubts about buying pressure.” Until then, the prevailing scenario remains one of continued upward momentum.

Cabrero also pointed to the international picture, which remains decidedly bullish after markets in Paris and Frankfurt decisively broke through historical resistance at 24,800-25,000 points and 8,200-8,330 points, respectively. However, he cautioned that breaking resistance “does not guarantee linear trajectories nor does it eliminate the risk of corrections or consolidations, which are inherent in any mature uptrend.”

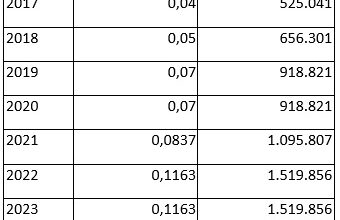

Technical analysis of the Ibex 35

“The underlying message from the market is that the next declines, when they arrive, will likely be vulnerable and should be interpreted as opportunities to buy again rather than the start of something more serious, especially if targets like 9,000 points in the French CAC have not yet been reached,” the expert added.

While the start of 2026 may continue to be constructively bullish, markets do not move in a straight line. “There will be scares, just as there were last April with the excuse of tariffs,” Cabrero warned.

Silver Tumbles Up to 7%

It was a day of losses in the commodities market, with precious metals leading the declines. Silver was the biggest laggard, with the price of an ounce falling as much as 7% after U.S. President Donald Trump delayed a decision on imposing new tariffs on critical mineral imports. Gold, platinum, and palladium also registered declines, though to a lesser extent.

Away from metals, Brent crude also posted significant losses, falling nearly 3.5% following statements from the U.S. president in which he said he was calmer about the situation in Iran and Tehran’s reprisals against protesters. Despite the comments, Iran has temporarily closed the airspace around its capital amid ongoing tensions with the United States.